Budgeting for Startups: How to Plan Monthly Costs When Business Is Unpredictable

Budgeting for startups sounds simple until real life hits. One month you land a big client. The next month payments …

Budgeting for startups sounds simple until real life hits.

One month you land a big client. The next month payments slow, churn creeps in, and expenses keep running. For early-stage founders, freelancers, and small teams, unpredictable income is the rule, not the exception.

This guide shows you how to plan monthly costs when business is unpredictable, without overcomplicating your finances or relying on guesswork. You will learn a practical startup budgeting system, see a short real-world story, and walk away with a framework you can use immediately.

Why Budgeting for Startups Is Different

Budgeting for startups is not the same as budgeting for established businesses. Large companies rely on stable revenue, historical trends, and predictable customer behavior. Startups rarely have any of that.

Instead, founders deal with:

- Inconsistent monthly income

- Limited financial history

- Rapid changes in expenses

- Pressure to grow while preserving cash

A startup budget must stay flexible. It should guide decisions, not lock you into unrealistic assumptions.

The Real Challenge of Unpredictable Revenue

Unpredictable revenue creates emotional and financial stress. When income fluctuates, founders often react instead of plan.

Common reactions include freezing spending entirely or overspending after a good month. Neither approach works long term.

Effective budgeting for startups focuses less on perfect predictions and more on control, visibility, and fast adjustments

A Short Story: The Month That Almost Broke the Startup

Alex ran a small SaaS startup with two contractors. March looked great. Revenue hit a record high, so Alex upgraded tools, increased ad spend, and committed to new software subscriptions.

Suggested read: Business vs. Pleasure: The Danger of Commingling Funds

April was different. Two clients delayed payment, churn spiked, and revenue dropped by 40 percent. Fixed expenses stayed the same. Cash runway shrank overnight.

The problem was not revenue. The problem was budgeting without a safety margin. Alex rebuilt the budget around minimum guaranteed income, variable spending rules, and a monthly review. The startup survived, and cash flow stabilized within three months.

This is why budgeting for startups must assume volatility, not hope for stability.

Step-by-Step: How to Budget Monthly Costs for a Startup

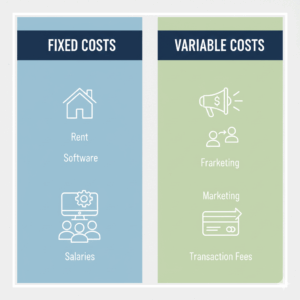

1. Separate Fixed and Variable Expenses

Start by listing every monthly cost.

Fixed costs stay relatively stable:

- Rent or coworking space

- Core software subscriptions

- Salaries or contractor retainers

- Insurance and accounting fees

Variable costs change with activity:

- Marketing and ads

- Payment processing fees

- Usage-based software

- Freelancers paid per project

This separation is the foundation of smart startup budgeting.

2. Build a Conservative Revenue Baseline

Do not budget based on your best month. Use your lowest reliable monthly revenue instead.

Ask yourself:

- What revenue can I reasonably expect even in a slow month?

- Which clients or products are most consistent?

This conservative baseline protects your startup when income drops.

Suggested read: Grant Opportunities: Preparing Your Financials for Federal & State Grants

3. Cap Variable Spending with Rules

Instead of fixed budgets for variable costs, use rules.

Examples:

- Marketing spend cannot exceed 20 percent of last month’s revenue

- Contractor hours scale only after revenue clears a set threshold

Rules keep spending aligned with reality and prevent emotional decisions.

4. Budget Monthly, Not Annually

Annual budgets rarely work for startups. Conditions change too fast.

Use a rolling monthly budget:

- Review actuals at the end of each month

- Adjust the next month’s plan

- Reforecast quarterly at most

This makes budgeting for startups adaptive instead of restrictive.

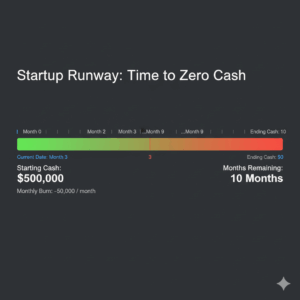

5. Track Burn Rate and Runway

Burn rate shows how much cash your startup spends each month. Runway tells you how long you can survive at that rate.

Knowing these numbers helps you decide when to cut costs, raise prices, or seek funding.

How Much Cash Buffer Should a Startup Have

A cash buffer protects you from late payments and sudden drops in revenue.

As a rule of thumb:

Suggested read: Vendor Negotiations: How to Demand Better Payment Terms in a Tight Economy

- Early-stage startups should aim for 3 to 6 months of fixed expenses in cash

- Service businesses with high variability may need closer to 6 months

Your buffer is part of your budget, not an afterthought.

Common Startup Budgeting Mistakes to Avoid

Many founders struggle with budgeting for startups because of avoidable mistakes.

Avoid these traps:

- Budgeting based on optimism instead of data

- Ignoring small recurring expenses

- Treating one-time revenue as recurring income

- Failing to review the budget monthly

A simple, reviewed budget beats a complex one that gets ignored.

Tools and Systems That Make Startup Budgeting Easier

Spreadsheets work at first, but they break as complexity grows.

Modern founders use tools that:

- Categorize expenses automatically

- Forecast cash flow dynamically

- Show burn rate and runway in real time

An AI-powered finance system like Zaccheus acts as an AI CFO, helping startups model scenarios, plan monthly costs, and make smarter decisions when revenue is unpredictable.

FAQs About Budgeting for Startups

What is the best budgeting method for startups?

The best budgeting method for startups is a flexible, rolling monthly budget. This approach adjusts expenses based on real performance and avoids long-term assumptions that rarely hold true in early-stage businesses.

How often should startups update their budget?

Startups should update their budget every month. Monthly reviews allow founders to respond quickly to revenue changes, manage burn rate, and prevent small issues from becoming cash flow crises.

How do startups budget with no predictable income?

When income is unpredictable, startups should budget using a conservative revenue baseline and prioritize fixed costs. Variable expenses should scale only after revenue is received, not before.

Suggested read: The “Agency” Dilemma: Managing Project-Based Finances vs. Recurring Revenue

Should startups budget growth expenses early?

Growth expenses should be budgeted carefully and tied to results. Startups should only increase growth spending when existing revenue supports it or when sufficient cash buffer exists.

How does cash flow differ from profit in startup budgeting?

Cash flow tracks when money enters and leaves your account, while profit measures long-term viability. For startups, cash flow matters more in the short term because it determines survival.

Conclusion: A Smarter Way to Budget for Startups

Budgeting for startups is not about predicting the future perfectly. It is about staying prepared when the unexpected happens.

By separating expenses, using conservative revenue assumptions, building a cash buffer, and reviewing monthly, founders can plan monthly costs even when business is unpredictable.

If you want a simpler, smarter way to manage startup finances, Zaccheus gives you an AI CFO that helps you budget, forecast, and stay in control without spreadsheets or stress.

Explore Zaccheus and start budgeting with confidence today.