CAC Annual Returns: Complete 2025 Filing Guide for Companies & Business Names

The CAC Annual Returns Deadline 2025 is fast approaching, and many Nigerian business owners are still unsure when and how …

The CAC Annual Returns Deadline 2025 is fast approaching, and many Nigerian business owners are still unsure when and how to file. Missing can lead to penalties, blocked updates, and even deregistration.

This guide explains the CAC Annual Returns 2025 for companies, business names, and NGOs, plus a simple breakdown of the filing process, required documents, and smart tips to stay compliant this year.

What Are CAC Annual Returns?

CAC Annual Returns are yearly updates filed with the Corporate Affairs Commission (CAC) by every registered business entity in Nigeria. They ensure that the company’s details like directors, shareholders, address, and business status are up to date. Annual returns are not tax filings. Instead, they are a legal compliance requirement to keep your registration valid.

CAC Annual Returns Deadline 2025 (By Entity Type)

The CAC Deadline depends on the type of business you run. Here’s the official breakdown according to CAC guidelines:

| Entity Type | 2025 Deadline | Notes |

|---|---|---|

| Limited Liability Companies (Ltd / Plc) | Within 42 days after your Annual General Meeting (AGM) | The first annual return is due 18 months after incorporation. |

| Business Names | On or before 30 June 2025 | Business names do not file in their year of registration. |

| Incorporated Trustees / NGOs | Between 30 June and 31 December 2025 | Audited accounts are required for filing. |

For new companies registered in 2024, the first filing will be due by mid-2026, since CAC grants an 18-month grace period from incorporation.

Why Meeting the CAC Annual Returns Deadline Matters

Filing before the CAC Annual Returns Deadline is not optional, it’s critical for several reasons:

-

Avoid Fines: Late filings attract penalties that grow each year of delay.

-

Stay Active: CAC may mark your company “inactive” if you miss the deadline.

-

Maintain Credibility: Clients, banks, and investors often request CAC compliance proof.

-

Enable Future Filings: You cannot update directors, share capital, or business names if your returns are overdue.

-

Prevent Deregistration: Prolonged non-compliance can lead to CAC delisting.

Meeting the Deadline keeps your business legitimate and ready for growth opportunities.

Suggested read: The Hidden Drain: 5 Ways Nigerian SMEs Lose Cash Without Noticing

Documents Required for 2025 CAC Filing

To file before the CAC , prepare the following documents depending on your entity type.

For Limited Liability Companies

-

RC Number

-

Company details (directors, shareholders, registered office)

-

Date and minutes of latest AGM

-

Financial statements or statement of affairs

-

Form CAC-19 (Annual Return for Companies)

For Business Names

-

BN Number

-

Proprietor information (names, addresses, signatures)

-

Business turnover or net assets

-

Form BN-06 (Annual Return for Business Names)

For Incorporated Trustees / NGOs

-

List of trustees and officers

-

Statement of assets and liabilities

-

Audited financial statements

-

Meeting minutes or resolutions

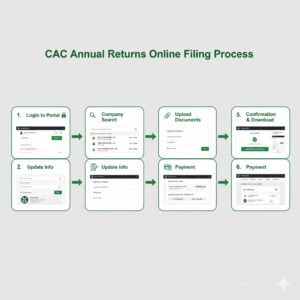

Step-by-Step: How to File Before the CAC Annual Returns Deadline 2025

You can file your CAC annual returns 2025 online through the CAC Portal. Follow these steps:

Suggested read: The Rise of the Zero-Employee Finance Department

Step 1: Log in to the CAC Portal

Visit post.cac.gov.ng and sign in using your registered email and password.

Step 2: Choose “Annual Returns” Service

Select the correct form:

-

Form CAC-19 for companies

-

Form BN-06 for business names

-

IT Annual Return Form for NGOs

Step 3: Fill in the Required Details

Enter company or proprietor details, AGM dates, share capital, or turnover. Ensure accuracy any mismatch with CAC records can cause delays.

Suggested read: The Joint Revenue Board: How Your NIN, BVN, and Tax ID Are Now Linked

Step 4: Upload Supporting Documents

Attach your audited accounts or statement of affairs (where applicable).

Step 5: Make Payment

Pay the CAC Annual Returns filing fee via debit card, Remita, or bank transfer.

Step 6: Submit and Download Acknowledgment

After successful payment, click Submit. You’ll receive an acknowledgment slip confirming your filing date proof that you met the CAC Annual Returns Deadline .

Filing Fees and Late Penalties

Here’s an updated list of filing fees and penalties for 2025:

| Entity Type | Filing Fee | Late Penalty (per year) |

|---|---|---|

| Business Names | ₦3,000 | ₦5,000 |

| Limited Liability Companies | ₦5,000 | ₦10,000–₦25,000 |

| NGOs / Incorporated Trustees | ₦5,000 | ₦10,000 |

Failure to meet the CAC Annual Returns Deadline 2025 can also delay post-registration services, including director updates or share transfers.

Common Mistakes That Cause CAC Delays

To ensure your CAC filing is approved before the CAC Annual Returns Deadline 2025, avoid these mistakes:

Suggested read: VAT Fiscalisation Explained: Why Your Business Needs Automated E-Invoicing Today

-

Submitting wrong AGM dates or incomplete records

-

Not updating director or shareholder details before filing

-

Uploading illegible documents or unsigned statements

-

Using the wrong CAC form (e.g., CAC-19 vs BN-06)

-

Ignoring portal error messages or payment confirmation

Always double-check your entries and documents before hitting “Submit.”

How to Back-File Missed CAC Annual Returns

Missed last year’s filing? You can still regularize your status before the CAC Annual Returns Deadline 2025 by back-filing:

-

Log into your CAC portal account.

-

Select “Annual Returns” and choose the missed year(s).

-

Pay all accumulated penalties.

-

Upload documents for each year.

-

Submit and download acknowledgment for each filing.

If your business has been delisted, you may need to apply for restoration through the CAC before back-filing.

Suggested read: Personal Income Tax vs Company Tax: Which Registration Is Better for You?

Conclusion: Don’t Miss the CAC Annual Returns Deadline 2025

The CAC Annual Returns Deadline 2025 is your business’s legal checkpoint. Whether you operate a company, business name, or NGO, filing your annual return ensures compliance, credibility, and continuity.

To stay on track, set a calendar reminder for June 30th and file early to avoid last-minute issues.

If you want help managing deadlines, payments, and compliance tracking, Zaccheus can automate it for you.

Visit usezaccheus.com your AI-powered CFO that helps startups, freelancers, and SMEs stay compliant with CAC, tax, and finance deadlines effortlessly.

FAQs on CAC Annual Returns Deadline 2025

1. When is the CAC Annual Returns Deadline 2025 for business names?

Business names must file by 30 June 2025, according to CAC regulations.

2. What about limited liability companies for the CAC annual returns of 2025?

Companies must file within 42 days after their AGM, and the first annual return is due 18 months after incorporation.

3. Do incorporated trustees have a different deadline?

Yes. Incorporated trustees or NGOs must file between June 30 and December 31, 2025.

Suggested read: Tax Credit for Going Digital in Nigeria: 2026 Guide

4. Can I file CAC Annual Returns late?

Yes, but you’ll pay penalties ranging from ₦5,000 to ₦25,000 depending on your entity type and delay period.

5. How do I know my filing was successful?

Once approved, you can download your acknowledgment slip from your CAC dashboard as proof of compliance.