How Much Cash Runway Does a Nigerian SME Actually Need?

Most small businesses do not fail because of bad ideas. They fail because something unexpected happens fuel prices rise, a …

Most small businesses do not fail because of bad ideas.

They fail because something unexpected happens fuel prices rise, a major customer delays payment, power costs spike, or sales slow suddenly.

Without an emergency fund, even a profitable Nigerian SME can collapse under short-term pressure.

The question is not whether emergencies will happen.

It is whether your business has enough cash runway to survive them.

What Is an Emergency Fund for a Business?

An emergency fund is cash set aside strictly to keep the business running during disruptions.

It is not for expansion.

It is not for opportunistic spending.

It is for survival.

This fund covers essential expenses when normal cash inflows slow or stop.

Why Nigerian SMEs Need Emergency Funds More Than Most

Operating in Nigeria comes with unique volatility:

- Fuel price shocks

- Exchange rate fluctuations

- Power supply instability

- Policy changes

- Delayed customer payments

These factors make predictable cash flow difficult.

An emergency fund provides breathing room when conditions shift suddenly.

Suggested read: The “Agency” Dilemma: Managing Project-Based Finances vs. Recurring Revenue

How Much Cash Runway Does a Nigerian SME Need?

There is no single number, but there is a clear framework.

The General Rule of Thumb

Most Nigerian SMEs should aim for 3–6 months of operating expenses as cash runway.

But this depends on your business type and risk level.

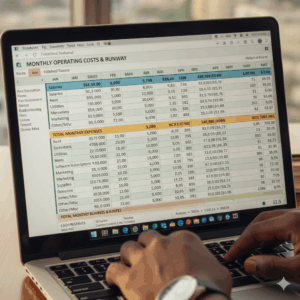

Step-by-Step: How to Calculate Your Emergency Fund

Step 1: List Your Fixed Monthly Costs

Include only expenses that keep the business alive:

- Rent

- Salaries

- Utilities and power

- Core software and tools

- Loan repayments

Exclude variable or discretionary costs.

Step 2: Identify Your Risk Profile

Ask yourself:

- Are your revenues predictable?

- Do customers pay on time?

- Are your costs sensitive to fuel or FX changes?

Higher uncertainty means a larger emergency fund.

Step 3: Choose Your Runway Period

Use this guide:

- 3 months: Stable income, low volatility

- 4–5 months: Moderate uncertainty

- 6 months: High volatility or seasonal income

Step 4: Do the Math

If your essential monthly expenses are ₦2 million:

- 3 months = ₦6 million

- 6 months = ₦12 million

That is your emergency fund target.

Suggested read: Valuation 101: How Clean Books Increase Your Company’s Worth

Common Mistakes SMEs Make

- Treating overdrafts as emergency funds

- Saving without separating the money

- Underestimating indirect costs

- Dipping into reserves for convenience

An emergency fund only works if it is protected.

A Short Story: The Business That Bought Time

A retail SME faced a sudden drop in sales after a fuel price increase.

Because they had four months of expenses saved, they did not panic.

They renegotiated supplier terms, adjusted pricing, and stabilized operations.

The emergency fund did not make them rich.

It kept them alive long enough to adapt.

Where Should You Keep Your Emergency Fund?

Accessibility matters.

- Separate business account

- High-liquidity savings or money market instruments

- Low risk, easy access

Avoid tying emergency funds to long-term investments.

How Zaccheus Helps You Build the Right Emergency Fund

Guessing is dangerous.

Zaccheus, helps you:

- Identify true fixed costs

- Calculate realistic cash runway

- Monitor reserves over time

- Know when you are dipping too low

Visibility turns fear into control.

Suggested read: Business vs. Pleasure: The Danger of Commingling Funds

Final Thoughts

An emergency fund is not pessimism.

It is preparation.

For Nigerian SMEs, cash runway is not a luxury. It is protection against volatility.

If you do not decide how long your business can survive without income, circumstances will decide for you.

Call to Action

Stop hoping nothing goes wrong.

Visit usezaccheus.com and let Zaccheus help you calculate your emergency fund, track cash runway, and build a more resilient business.

Frequently Asked Questions (FAQs)

1. Is an emergency fund the same as business savings?

No.

Business savings are often used for future plans like expansion, marketing, or equipment.

An emergency fund is strictly for keeping the business alive when cash inflows slow or stop. It should not be touched for routine expenses.

2. Can a profitable business still need an emergency fund?

Yes.

Profitability does not guarantee liquidity. A business can be profitable on paper and still collapse if cash is unavailable when expenses are due. An emergency fund protects against timing gaps, not bad performance.

3. Should I use an overdraft instead of keeping cash aside?

Overdrafts are not emergency funds.

They increase liabilities, attract interest, and may be withdrawn unexpectedly. An emergency fund is your own cash, available immediately without new debt.

4. How fast should a small business build an emergency fund?

Gradually.

Start by setting aside a fixed percentage of monthly revenue or profits. Even one month of runway is better than none. Consistency matters more than speed.

Suggested read: Scenario Planning: “What If Sales Drop 20%?” Modeling Best & Worst Cases

5. What if my business income is seasonal?

Seasonal businesses should aim closer to six months of runway.

Emergency funds should cover the longest expected low-income period plus a buffer for unexpected shocks.

6. Should emergency funds be kept in naira or foreign currency?

It depends on your exposure.

If your major costs are local, naira is appropriate. If your business relies heavily on imports or FX-priced inputs, holding a portion in foreign currency may reduce risk.

7. How do I stop myself from dipping into the emergency fund?

Separation is key.

Use a dedicated account and treat the fund as non-negotiable. If spending from it does not prevent business shutdown, it probably does not qualify as an emergency.

8. How often should I review my emergency fund size?

At least every six months, or whenever your costs or risk profile change.

Rising fuel prices, new loans, staff increases, or FX exposure all affect how much runway you need.

9. Can startups or very small businesses realistically maintain an emergency fund?

Yes, but the amount may be smaller at first.

Emergency funds scale with your business. What matters is building the habit early, not waiting until the business is “big enough.”

10. How does Zaccheus make emergency fund planning easier?

Zaccheus removes guesswork by showing you:

- True fixed costs

- Real cash burn rate

- How long your reserves will last

- When your runway is shrinking dangerously

This helps you plan before pressure forces bad decisions.