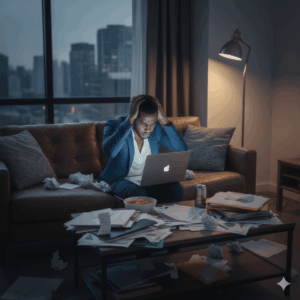

Financial Anxiety: How Automated Books Cure “Sunday Night Panic”

Financial anxiety often shows up right on schedule. It creeps in on Sunday night, just as the week approaches. You …

Financial anxiety often shows up right on schedule.

It creeps in on Sunday night, just as the week approaches. You start replaying unanswered questions. Did clients pay? Can payroll clear? Are expenses under control? Nothing feels urgent enough to fix immediately, yet everything feels heavy.

Most founders do not fear hard work. They fear uncertainty. And nothing creates uncertainty faster than unclear finances.

Why Sunday Night Panic Is a Finance Problem

Sunday night stress is rarely about motivation.

It is about not knowing.

Founders experience anxiety when:

- Bank balances feel unpredictable

- Expenses surprise them

- Invoices are untracked

- Reports are outdated

When answers require digging through emails or spreadsheets, the mind fills gaps with worst-case assumptions.

Clarity calms the nervous system.

The Cost of Financial Anxiety on Founders

Unchecked anxiety affects more than mood.

It leads to:

Suggested read: Business vs. Pleasure: The Danger of Commingling Funds

- Poor sleep

- Reactive decisions

- Avoidance of financial tasks

- Short-term thinking

Over time, founders stop looking at their numbers altogether. That avoidance creates even more anxiety, forming a quiet cycle that hurts both leadership and business health.

Why Manual Books Make Anxiety Worse

Manual bookkeeping depends on memory and discipline.

That means:

- Transactions pile up

- Reconciliation gets delayed

- Numbers fall behind reality

- Reports feel unreliable

When books lag weeks behind, founders operate in the dark. Anxiety thrives where visibility is missing.

Automation closes that gap.

How Automated Books Restore Calm

Automated bookkeeping removes friction.

It works by:

- Syncing transactions in real time

- Categorizing expenses consistently

- Updating cash position automatically

- Reducing human error

When financial data updates continuously, founders stop guessing. They start knowing.

That shift alone reduces stress dramatically.

What Founders Feel When Books Are Automated

Something subtle but powerful happens.

Suggested read: The “Agency” Dilemma: Managing Project-Based Finances vs. Recurring Revenue

Founders report:

- Less dread before reviewing finances

- More confidence during decisions

- Fewer emotional reactions to numbers

- Better sleep before Mondays

The numbers stop feeling accusatory. They start feeling informative.

Why Visibility Beats Motivation

Motivation does not cure anxiety.

Visibility does.

When founders can open a dashboard and instantly see:

- Cash on hand

- Outstanding invoices

- Upcoming expenses

- Monthly trends

There is no room for imagined disasters. Reality replaces fear.

Automated Books Improve More Than Mental Health

Clarity improves operations too.

Automated books lead to:

- Better budgeting

- More intentional spending

- Cleaner tax preparation

- Stronger investor confidence

The emotional benefit is immediate. The strategic benefit compounds over time.

How Zaccheus Reduces Financial Anxiety for Founders

Zaccheus works like an AI CFO that keeps books continuously up to date.

Suggested read: Grant Opportunities: Preparing Your Financials for Federal & State Grants

It helps founders:

- See real-time financial health

- Eliminate reporting delays

- Reduce manual bookkeeping stress

- Replace Sunday panic with calm insight

Instead of dreading financial review, founders regain control and peace of mind.

Frequently Asked Questions

What causes financial anxiety in founders?

It usually comes from uncertainty around cash flow, expenses, and financial obligations rather than lack of effort.

Can automation really reduce financial stress?

Yes. Automation removes delays and guesswork, which are major drivers of anxiety.

Is financial anxiety common among founders?

Very common. Many founders experience it silently, especially during early growth stages.

Does automated bookkeeping replace accountants?

No. It supports better data flow and reduces manual work, making professional advice more effective.

When should a founder automate their books?

As early as possible. Early habits create long-term stability.

Conclusion

Financial anxiety is not a personal weakness.

It is a signal that visibility is missing. Automated bookkeeping replaces uncertainty with clarity, turning Sunday night panic into quiet confidence.

Zaccheus helps founders stay grounded by keeping financial reality visible at all times.

Suggested read: Unit Economics: Calculating Your Customer Acquisition Cost (CAC) in Naira

Explore Zaccheus and start your week with calm, not fear.