Personal Income Tax vs Company Tax: Which Registration Is Better for You?

At the start, most founders just want to get paid. You register quickly, send invoices, and move on. Taxes feel …

At the start, most founders just want to get paid.

You register quickly, send invoices, and move on. Taxes feel like something to “figure out later.” But later comes fast. Suddenly clients ask for company details, compliance emails start coming in, and you realize your tax structure might be holding you back.

This is where the personal income tax vs company tax question stops being theoretical and becomes personal.

Here’s how to choose the option that works now and still makes sense as you grow.

What Is Personal Income Tax in Nigeria?

Personal income tax applies when you run your business as an individual, usually as a sole proprietor or freelancer.

Under this structure:

- The business and the owner are legally the same

- Income is taxed under personal income tax rules

- Business profits are treated as personal earnings

This setup is common for freelancers, creators, consultants, and early-stage founders who want to move fast.

What Is Company Tax in Nigeria?

Company tax applies when your business is registered as a separate legal entity, usually a limited liability company.

In this case:

- The company is taxed independently

- Owners are taxed separately on salaries or dividends

- Compliance requirements are more structured

This structure signals seriousness, even when the team is small.

Suggested read: Tax Credit for Going Digital in Nigeria: 2026 Guide

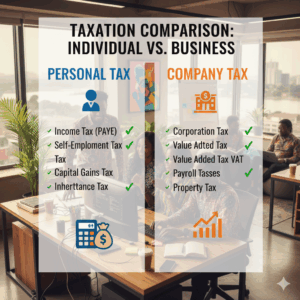

Key Differences Between Personal and Company Tax

Understanding personal income tax and company tax becomes easier when you compare them side by side.

Tax Rates and Structure

Personal income tax is progressive. As income increases, tax rates rise.

Company income tax is fixed at the company level, regardless of the owner’s personal income.

Compliance Expectations

Personal tax compliance is simpler, but less flexible.

Company tax compliance is more demanding, but clearer as businesses scale.

Business Credibility

Many corporate clients, investors, and partners prefer dealing with registered companies.

This matters more than founders often expect.

Which Option Makes Sense at Different Stages?

Early Stage or Solo Operator

If you are testing an idea, freelancing, or earning inconsistently, personal income tax often makes sense.

It keeps things simple while you find your footing.

Growing Business With Steady Revenue

Once income stabilizes and clients become more formal, company registration starts to make sense.

Suggested read: The ₦100M Tax Threshold: What Nigerian Founders Must Know

It protects you legally and opens more doors.

Scaling or Fundraising

If you plan to raise capital, partner with institutions, or scale aggressively, company tax is almost unavoidable.

Most investors will not engage otherwise.

Mistakes Founders Commonly Make

Many founders struggle because they:

- Stay on personal tax long after growth demands a company

- Register a company too early without understanding compliance

- Mix personal and business finances

- Guess tax obligations instead of tracking them

These mistakes blur the line between personal income tax vs company tax in Nigeria and create avoidable stress.

How Smart Founders Decide

Smart founders do not ask, “Which is cheaper today?”

They ask, “Which supports my next phase?”

They look at:

- Revenue trajectory

- Client expectations

- Compliance capacity

- Long-term vision

This is why financial clarity tools matter.

Platforms like Zaccheus, an AI CFO for Nigerian founders, help business owners understand when to transition, model tax outcomes, and stay compliant without overcomplicating things.

Suggested read: The 2025 Finance Act: 5 Clauses That Will Change How You Do Business

Frequently Asked Questions

Can I switch from personal tax to company tax later?

Yes. Many founders start with personal tax and transition to company registration as the business grows.

Does company registration always mean higher taxes?

Not always. In some cases, company tax provides more predictability and planning flexibility.

Can freelancers register a company?

Yes. Freelancers with steady income often register companies for credibility and growth.

What happens if I choose the wrong structure?

You may overpay taxes, face compliance issues, or struggle with clients and partners.

How do I know when to switch?

When revenue grows, clients become formal, or compliance risk increases, it is time to reassess.

Conclusion: The Best Choice Is the One That Fits Your Future

The choice between personal income tax and company tax in Nigeria isn’t about right or wrong.

It is about timing and intention.

The best structure today may not be the best one tomorrow.

Founders who revisit this decision early avoid stress later and grow with confidence.

Call to Action

If you want clarity on your tax structure, compliance, and growth path without confusion, explore Zaccheus, the AI CFO built to help Nigerian founders make smarter financial decisions at every stage.