The Hidden Drain: 5 Ways Nigerian SMEs Lose Cash Without Noticing

Most Nigerian SMEs do not fail because sales are low. They fail because cash quietly leaks out every day. These …

Most Nigerian SMEs do not fail because sales are low.

They fail because cash quietly leaks out every day.

These losses rarely look dramatic. No fraud alert. No empty bank account overnight. Just small decisions, ignored expenses, and poor visibility that slowly drain the business.

This article breaks down five hidden ways Nigerian SMEs lose cash without noticing, why these leaks are so common, and what founders can do to stop them before they become fatal.

Why Cash Leakage Is So Common in Nigerian SMEs

Running a business in Nigeria comes with unique pressure:

- Inflation is unpredictable

- Exchange rates fluctuate constantly

- Access to affordable capital is limited

- Founders juggle many roles at once

In this environment, finance often becomes reactive instead of intentional. When visibility is low, small cash leaks stay invisible until it is too late.

Hidden Drain #1: Expense Creep That Goes Untracked

Expense creep is one of the most dangerous cash leaks because it feels harmless.

Small costs slowly add up:

- Extra data subscriptions

- Unused software tools

- Repeated logistics overruns

- Staff reimbursements without review

Most Nigerian SMEs do not review expenses weekly. Some do not review them at all.

Suggested read: How to Manage Cash Sales, Cash Expenses, and Keep Clean Records

Without clear categorization and alerts, businesses keep paying for things they no longer need. Over time, margins disappear quietly.

Hidden Drain #2: Poor Cash Flow Visibility

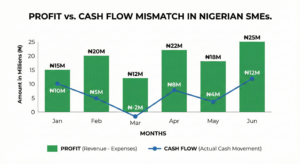

Many SMEs track profit but ignore cash flow.

This creates a dangerous illusion where:

- Sales look strong

- Profit appears healthy

- Cash is always tight

The reason is timing. Money coming in does not always match money going out.

Rent, salaries, supplier payments, and loan repayments often hit before revenue lands. Without real-time cash flow tracking, founders are forced to guess.

Hidden Drain #3: Unpaid Invoices and Weak Collections

Unpaid invoices are silent killers for Nigerian SMEs.

Many businesses:

- Delay sending invoices

- Avoid following up to appear polite

- Do not track aging receivables

Meanwhile, expenses continue regardless of whether customers pay.

A business can be profitable on paper and still collapse because cash never arrives on time.

Strong collection processes are not aggressive. They are necessary for survival.

Suggested read: The “Agency” Dilemma: Managing Project-Based Finances vs. Recurring Revenue

Hidden Drain #4: FX Losses and Currency Inefficiencies

Foreign exchange is a unique cash drain for Nigerian businesses.

Common issues include:

- Paying suppliers at poor exchange rates

- Holding naira while expenses are dollar-based

- Not tracking FX losses as real costs

These losses often do not appear clearly in reports. They show up as unexplained shortfalls instead.

Without visibility into currency exposure, SMEs bleed value slowly.

Hidden Drain #5: Manual Finance and Guesswork Decisions

Spreadsheets, WhatsApp notes, and mental math are still common tools for SME finance.

This leads to:

- Late insights

- Inaccurate forecasts

- Decisions based on intuition instead of data

Manual finance creates blind spots. By the time problems appear, options are limited.

Automation does not just save time. It prevents expensive mistakes.

How Nigerian SMEs Can Stop the Hidden Drain

Stopping cash leakage starts with visibility.

Suggested read: Business vs. Pleasure: The Danger of Commingling Funds

Smart SMEs focus on:

- Real-time expense tracking

- Cash flow forecasting

- Automated alerts for unusual activity

- Clear answers to financial questions

Instead of hiring expensive finance teams, many businesses now rely on AI-powered financial tools that act like a virtual CFO.

These tools surface problems early and explain them clearly, before cash disappears.

Frequently Asked Questions

Why do Nigerian SMEs struggle with cash even when sales are good?

Because cash flow timing, expenses, FX losses, and unpaid invoices are not visible. Profit does not equal cash.

What is the biggest hidden cash drain for SMEs?

Expense creep combined with poor cash flow visibility. Small leaks compound into major losses.

How can SMEs improve cash flow visibility?

By using tools that track transactions in real time and forecast future cash positions automatically.

Are financial leaks always due to fraud?

No. Most leaks are operational, not intentional. They happen due to poor tracking and delayed insights.

Can automation really help small businesses?

Yes. Automation reduces human error, improves visibility, and helps founders make decisions faster.

Conclusion

The biggest threat to Nigerian SMEs is not competition.

It is cash loss they do not see coming.

These hidden drains grow quietly until they choke the business. The solution is not working harder. It is seeing clearer.

Suggested read: Grant Opportunities: Preparing Your Financials for Federal & State Grants

When founders understand where money goes, why it moves, and what happens next, survival becomes growth.

Call to Action

If you want to stop cash leaks before they hurt your business, explore how Zaccheus acts as an AI CFO for Nigerian SMEs.

Zaccheus gives you real-time visibility, clear explanations, and smarter financial control without hiring a finance team.

Visit usezaccheus.com to see your numbers clearly.