The Rise of the Zero-Employee Finance Department

Hiring a full finance team used to be a requirement for growth. Today, it is becoming a liability. Founders are …

Hiring a full finance team used to be a requirement for growth. Today, it is becoming a liability.

Founders are questioning why finance still depends on headcount when sales, marketing, and operations have already gone digital. This shift has led to a powerful new model called the Zero-Employee Finance Department.

In this guide, you will learn what a Zero-Employee Finance Department is, why it is rising fast, how it works in practice, and how modern startups use AI CFO tools like Zaccheus to run finance without hiring accountants, controllers, or CFOs.

What Is a Zero-Employee Finance Department?

A Zero-Employee Finance Department replaces human finance roles with automated systems and AI-driven decision support.

Instead of hiring:

- Bookkeepers

- Accountants

- Financial controllers

- Fractional CFOs

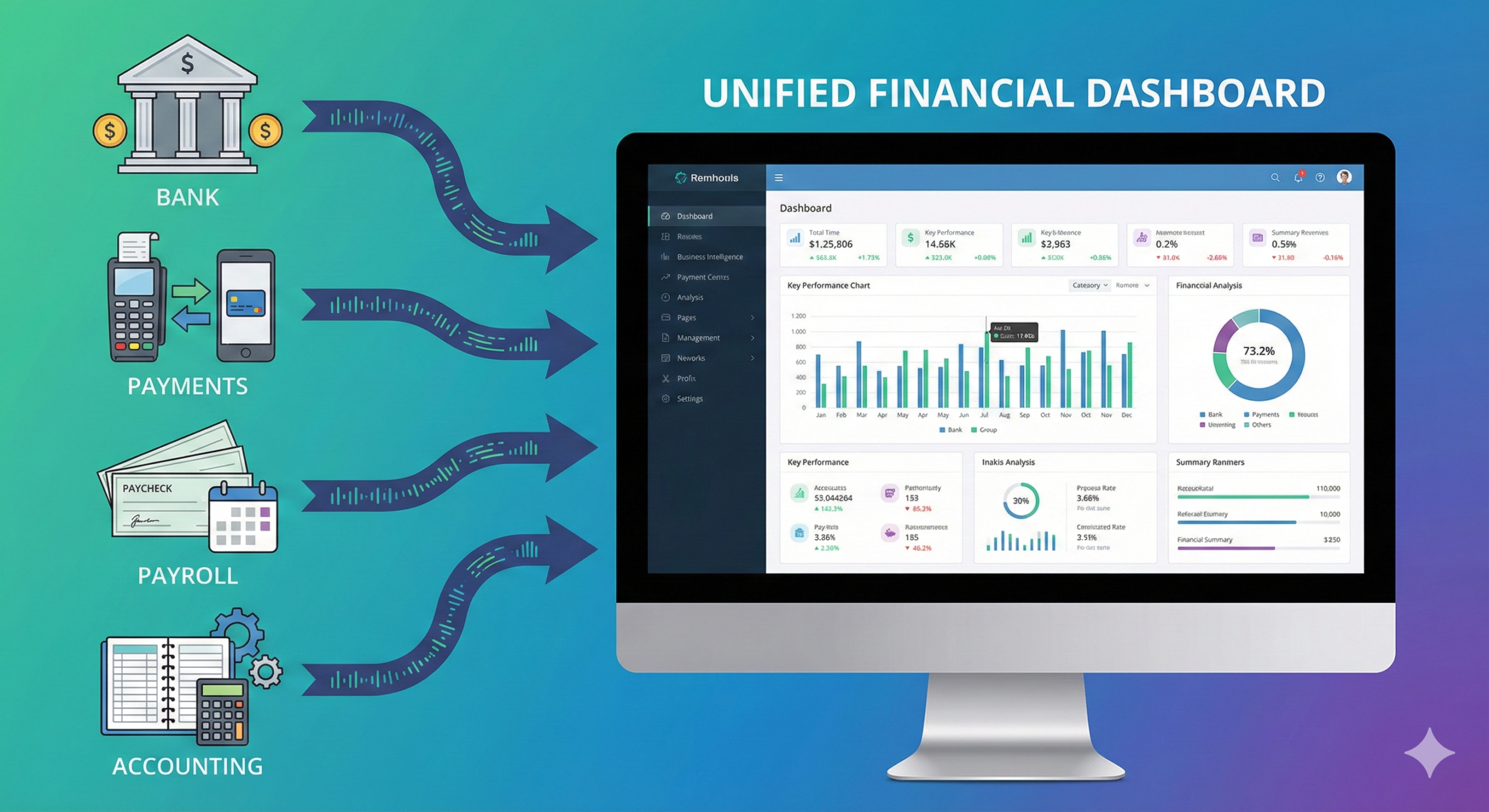

Businesses rely on integrated financial software that connects directly to bank accounts, payment processors, payroll systems, and accounting platforms.

At the center of this setup is an AI CFO that interprets the data, flags risks, answers financial questions, and provides forward-looking insights.

This does not mean finance disappears. It means finance becomes lean, always-on, and scalable without payroll overhead.

Why the Zero-Employee Finance Department Is Rising

Rising Costs of Finance Talent

Hiring finance professionals has become expensive and slow. According to market data from Glassdoor and LinkedIn:

Suggested read: The Future of Work and Remote Finance Teams in Nigeria

- Senior accountants often cost six figures

- Fractional CFOs still charge thousands per month

- Finance hiring cycles can take months

For early-stage companies, this cost is hard to justify.

Better Financial Software

Modern finance tools no longer just store data. They analyze it.

AI now:

- Categorizes transactions accurately

- Detects anomalies

- Predicts cash flow issues

- Simulates future scenarios

This level of intelligence was once limited to enterprise finance teams.

Founder Demand for Real-Time Answers

Founders do not want monthly reports anymore. They want instant clarity.

Questions like:

- Can I afford to hire next month?

- Why did cash drop this week?

- What happens if revenue slows by 10 percent?

The Zero-Employee Finance Department answers these questions instantly instead of waiting for a human to respond.

How a Zero-Employee Finance Department Works

1. Automated Data Collection

Financial data flows automatically from:

- Bank accounts

- Credit cards

- Stripe, PayPal, or other payment tools

- Payroll platforms

- Accounting software

No manual uploads. No chasing receipts.

2. AI-Driven Financial Intelligence

The system analyzes transactions continuously and converts raw data into insights such as:

Suggested read: The Hidden Drain: 5 Ways Nigerian SMEs Lose Cash Without Noticing

- Burn rate tracking

- Runway calculations

- Expense trends

- Revenue forecasts

This is where the Zero-Employee Finance Department replaces human judgment with machine precision.

3. Real-Time Reporting and Alerts

Instead of static reports, businesses receive:

- Live dashboards

- Automated alerts

- Plain-English explanations of financial changes

If cash flow dips or expenses spike, the system flags it immediately.

4. Strategic Guidance Without Headcount

The most advanced setups include an AI CFO that:

- Answers financial questions conversationally

- Models scenarios

- Recommends actions based on data

This is the final layer that makes a Zero-Employee Finance Department viable long term.

Key Benefits for Startups and SMEs

Lower Costs Without Sacrificing Insight

The Zero-Employee Finance Department removes salary, benefits, and recruiting costs while maintaining high-quality financial visibility.

Faster Decision Making

Automated finance eliminates delays. Decisions happen based on current data, not last month’s spreadsheet.

Scalability From Day One

As revenue grows, finance scales automatically. No rehiring, no restructuring, no added management complexity.

Reduced Human Error

Automation minimizes:

- Manual data entry mistakes

- Missed transactions

- Inconsistent reporting logic

Founder-Friendly Experience

Instead of financial jargon, insights are delivered in clear language that non-finance founders understand.

Suggested read: Business vs. Pleasure: The Danger of Commingling Funds

Zero-Employee Finance vs Traditional Finance Teams

| Area | Traditional Finance Team | Zero-Employee Finance Department |

|---|---|---|

| Cost | High fixed salaries | Low predictable software cost |

| Speed | Monthly or quarterly | Real time |

| Scalability | Requires hiring | Scales automatically |

| Insights | Retrospective | Predictive and proactive |

| Availability | Business hours | 24/7 |

Common Myths and Misconceptions

“It Replaces All Human Oversight”

A Zero-Employee Finance Department does not eliminate accountability. Founders and operators still make decisions. The difference is that insights arrive instantly.

“It Is Only for Tech Companies”

Any business with digital financial data can adopt this model, including agencies, ecommerce brands, consultants, and freelancers.

“AI Finance Is Not Accurate”

Modern AI finance tools train on large datasets and use rules that reduce inconsistency. In many cases, accuracy improves compared to manual workflows.

Who Should Adopt a Zero-Employee Finance Department?

This model works best for:

- Startups under 100 employees

- Bootstrapped founders

- Freelancers managing growing revenue

- SMEs tired of reactive finance

- Teams that want insight before problems appear

If finance feels like a black box today, this approach is likely a fit.

How Zaccheus Powers the Zero-Employee Finance Department

Zaccheus is built specifically to act as an AI CFO for businesses that do not want a traditional finance department.

With Zaccheus, you get:

- Real-time financial visibility

- Plain-language answers to finance questions

- Cash flow forecasting and scenario planning

- Automated insights without spreadsheets

- A finance system that runs without employees

Instead of reacting to numbers, you operate with confidence.

Frequently Asked Questions

What is a Zero-Employee Finance Department?

A Zero-Employee Finance Department is a finance setup that uses automation and AI tools instead of in-house staff. It manages bookkeeping, reporting, forecasting, and insights without hiring employees.

Suggested read: Grant Opportunities: Preparing Your Financials for Federal & State Grants

Is a Zero-Employee Finance Department safe?

Yes, when built with reputable tools that follow security standards. Data is often more secure than manual handling because access is controlled and logged.

Can AI really replace a CFO?

AI does not replace leadership. It replaces repetitive analysis and reporting. Founders still make decisions, but with faster and clearer information.

How much does a Zero-Employee Finance Department cost?

Costs vary by tool but are typically far lower than hiring even one finance professional. Most businesses save thousands per month.

When should a startup adopt this model?

The earlier, the better. Many startups adopt a Zero-Employee Finance Department from day one to avoid building costly finance structures later.

Conclusion

The Zero-Employee Finance Department is not a trend. It is a response to how modern businesses operate.

Founders want clarity, speed, and control without growing headcount. AI-driven finance makes this possible by replacing outdated workflows with always-on intelligence.

If you want finance that works as fast as your business does, the Zero-Employee Finance Department is the future.

Call to Action

Ready to run finance without hiring a team?

Explore how Zaccheus acts as your AI CFO and powers a true Zero-Employee Finance Department.

Visit usezaccheus.com and see how modern finance should work.