Smart Ways to Reduce Payment Gateway Fees in Nigeria and Boost Profit (2025 Guide)

Introduction If you run an online business in Nigeria, you’ve probably noticed how payment charges add up quickly. Learning how …

Introduction

If you run an online business in Nigeria, you’ve probably noticed how payment charges add up quickly. Learning how to reduce payment gateway fees in Nigeria can help you protect your margins, improve cash flow, and scale sustainably.

In this guide, you’ll learn how to reduce payment gateway fees in Nigeria without sacrificing speed, reliability, or customer experience. We’ll break down the real cost structures behind popular gateways, reveal insider tactics for negotiating better rates, and show you practical ways to optimize your payment methods to save more money each month. Learning how to reduce payment gateway fees in Nigeria helps businesses save costs and improve profit margins.

Featured Snippet Answer (Quick Summary)

To reduce payment gateway fees in Nigeria, compare providers’ fee structures, negotiate based on transaction volume, prioritize low-cost local methods like bank transfers or USSD, and minimize chargebacks or refunds. Choosing transparent, domestic gateways and leveraging fintech tools like Zaccheus for financial analysis can cut overall costs by up to 30%.

What Are Payment Gateway Fees & Why They Matter in Nigeria

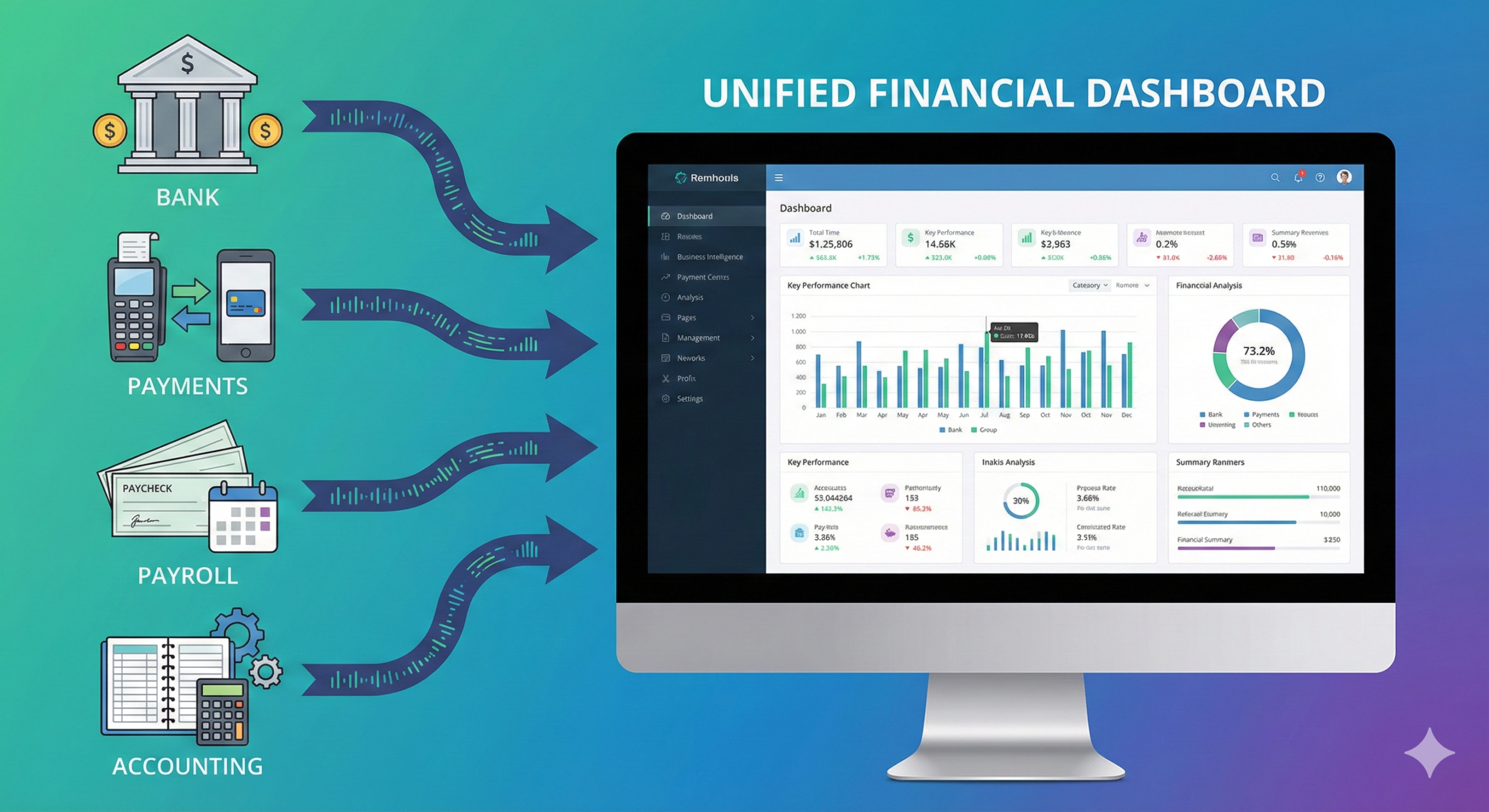

A payment gateway processes online payments between customers and merchants. Each transaction carries fees from different parties — processors, card networks, and banks.

In Nigeria, where inflation and exchange rates fluctuate frequently, small percentage fees can significantly impact profits. A 1.5% fee might sound trivial, but at ₦10 million in monthly revenue, that’s ₦150,000 lost to fees alone.

For startups and SMEs, lowering these costs directly boosts profit margins and competitiveness. That’s why knowing how to reduce payment gateway fees in Nigeria is a crucial part of financial management.

Typical Fee Structures for Nigerian payment Gateways fees

| Gateway | Local Transaction Fee | International Transaction Fee | Setup / Maintenance |

|---|---|---|---|

| Paystack | 1.5% + ₦100 (₦100 waived under ₦2,500) | 3.9% + ₦100 | No setup fee |

| Flutterwave | 1.4% capped at ₦2,000 | 3.8% + ₦100 | No setup fee |

| Interswitch Webpay | 1.5% (capped for high-value transactions) | 3.8%–4% | May charge setup fee |

| GTPay | ~1.5% local | ~3.8% international | ₦75,000 setup for some businesses |

💡 Tip: Always check for hidden costs like currency conversion markups, chargeback fees, or withdrawal charges that can raise your total payment processing cost.

Key Factors That Drive Up Your Costs

- International Transactions: Higher scheme and FX fees.

- Card Types: Foreign cards cost more than domestic Verve or Naira cards.

- Low Transaction Volumes: Smaller merchants often pay higher rates.

- Hidden Fees: Setup, maintenance, or settlement delays.

- Chargebacks and Refunds: Increase effective costs.

- Compliance Costs: CBN regulations and VAT add small but cumulative fees.

Understanding these cost drivers allows you to implement smarter strategies for reduction.

Suggested read: The Hidden Drain: 5 Ways Nigerian SMEs Lose Cash Without Noticing

Best Platforms to Reduce Payment Gateway Fees in Nigeria

1. Compare and Choose the Right Gateway

Don’t settle for the first provider you find. Compare multiple gateways based on:

- Local vs international fee differences

- Settlement speed (some settle daily, others weekly)

- Capped fees for large transactions

- API reliability and dispute resolution

2. Negotiate with Providers

Gateways rarely advertise their lowest rates. To get discounts:

- Highlight your transaction volume or projected growth.

- Negotiate for tiered pricing (e.g., lower rates above ₦5M monthly).

- Request fee caps for large payments.

- Ask for waivers on settlement or withdrawal charges.

Many Nigerian startups have reduced fees from 1.5% to 1.2% simply through negotiation.

3. Optimize Your Payment Mix

Encourage cheaper payment methods at checkout:

- Promote bank transfers or USSD payments.

- Offer small discounts for customers using low-cost methods.

- Minimize international card transactions when possible.

Zaccheus’ AI CFO tool can automatically identify your highest-cost payment channels and recommend cheaper alternatives in real time.

4. Use Lower-Cost or Emerging Payment Methods

- Bank transfers (NIP): Often cheaper and faster.

- QR codes & mobile wallets: Many fintechs now offer these with sub-1% fees.

- AfriGo card scheme: CBN’s local card initiative that reduces dependency on Visa/MasterCard and lowers transaction fees.

Source: Central Bank of Nigeria (CBN)

5. Avoid Hidden or Unnecessary Charges

- Monitor chargebacks and reduce refund frequency.

- Avoid double conversions on foreign payments.

- Ask for a fee breakdown before signing any contract.

- Watch for monthly minimum transaction fees (common with enterprise plans).

Using a platform like Zaccheus can help automatically track and visualize these hidden costs from your bank feeds or gateway reports.

6. Leverage Volume & Scale

As your transaction volume grows, your bargaining power improves. Negotiate volume-based discounts or enterprise plans. If you run multiple businesses, consolidate transactions under one account to qualify for better rates.

7. Local vs International Transactions

If your customers are both local and foreign:

- Offer Naira pricing for local customers.

- Use multi-currency accounts for foreign clients to avoid FX markup.

- Choose gateways with transparent conversion rates.

Zaccheus’ reporting tool can project how much you’ll save by shifting part of your traffic from international to local channels.

Suggested read: The Rise of the Zero-Employee Finance Department

Case Studies / Examples

Example 1: E-commerce Startup

A Lagos-based fashion store reduced average gateway fees from 3.2% to 1.6% by encouraging customers to pay through bank transfers instead of cards.

Example 2: SaaS Platform

A software company processed ₦12 million monthly and negotiated capped fees with its provider, saving over ₦180,000 monthly.

Example 3: Freelancer

By switching to a fintech account that allowed USD invoicing with Naira settlement, a Nigerian freelancer avoided multiple FX conversions and reduced total fees by 20%.

Regulatory & Emerging Tools That May Help

- AfriGo Card Scheme (CBN): Designed to reduce reliance on foreign networks and lower processing fees.

- CBN’s Cashless Policy: Promotes digital payments and sets limits on merchant service charges.

- Open Banking APIs: Enable direct bank-to-bank payments, bypassing traditional gateways.

- Zaccheus AI CFO: Tracks payment fees, forecasts costs, and automates vendor negotiation insights for Nigerian businesses.

Read more: CBN Cashless FAQs (Official)

FAQ

Q1. What is a fair payment gateway fee in Nigeria?

Local card transactions should cost around 1.4–1.5%. International ones often range from 3.5–4%. Anything higher signals room for negotiation.

Q2. How can small businesses reduce payment fees?

Use bank transfers and low-fee payment links, and join associations that negotiate group discounts with gateways.

Q3. Are foreign gateways cheaper?

Not always. They may have lower fees but add costly FX conversion spreads and slower settlement times.

Q4. How can Zaccheus help with payment fee reduction?

Zaccheus’ AI CFO automatically audits your payment data, highlights fee inefficiencies, and suggests optimal gateways or methods to save money.

To reduce payment gateway fees in Nigeria, compare transaction charges across multiple providers.

Conclusion & Call to Action

Reducing payment gateway fees in Nigeria isn’t just about finding cheaper platforms; it’s about understanding your cost structure and using data to optimize every payment.

Suggested read: The Joint Revenue Board: How Your NIN, BVN, and Tax ID Are Now Linked

By comparing gateways, negotiating better rates, and analyzing transaction data with tools like Zaccheus, you can reduce fees, protect margins, and scale sustainably.

👉 Start saving money today — visit usezaccheus.com to discover how our AI CFO can track your gateway fees, negotiate better rates, and automate financial optimization for your business.