The Role of Technology in Financial Inclusion for Nigerian Entrepreneurs

Financial inclusion is a cornerstone of economic growth, yet many Nigerian entrepreneurs have historically faced barriers to accessing banking, loans, …

1. Understanding Financial Inclusion

Financial inclusion means giving individuals and businesses access to essential financial services such as bank accounts, credit, insurance, savings, and digital payments. For entrepreneurs, it goes beyond convenience. Inclusion ensures they can track revenue, understand profitability, invest in their operations, and compete in a formal marketplace where transparency matters. When entrepreneurs gain access to financial tools, they can move away from cash-only practices, build credit histories, and attract investors who rely on accurate financial records.

2. Challenges Nigerian Entrepreneurs Face

Many Nigerian entrepreneurs still experience obstacles that limit full participation in the financial system.

-

Limited Access to Bank Accounts: Small businesses sometimes struggle to open or maintain accounts because of documentation requirements or unpredictable cash flows.

-

Difficulty Accessing Credit: Traditional banks often request collateral that micro and small enterprises do not have, which prevents them from getting the capital needed for expansion.

-

Lack of Financial Literacy: Entrepreneurs may not have the tools or training to track income, expenses, or cash flow correctly, which makes planning difficult.

-

Inefficient Payment Systems: Delayed transfers, high transaction fees, and inconsistent network coverage can disrupt daily operations.

These challenges slow business growth and leave many entrepreneurs dependent on informal systems that do not support long-term success.

3. How Technology Bridges the Gap

Technology is creating more inclusive opportunities for Nigerian entrepreneurs by offering simpler, faster, and more affordable financial solutions.

Mobile Banking Apps: Major banks such as GTBank, Access Bank, and Zenith Bank offer mobile apps that allow users to open accounts, transfer funds, pay bills, and monitor transactions straight from their phones. Entrepreneurs no longer need to visit physical branches to manage finances.

Fintech Platforms: Services like Paystack, Flutterwave, and Remita help businesses accept online payments, manage invoices, and process local or international transactions. These platforms support entrepreneurs operating both offline and online.

Suggested read: The Future of Accounting Careers in Nigeria: What Graduates Should Expect

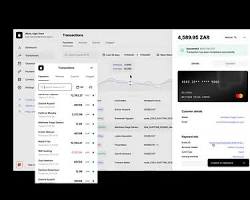

AI Tools: Platforms like Zaccheus give entrepreneurs access to automated cash flow analysis, budgeting tools, financial forecasting, and investor-ready reporting. These insights help them plan growth more confidently.

Digital Lending: Digital lenders offer microloans and working capital without demanding heavy collateral. This gives entrepreneurs the flexibility to invest in inventory, hire staff, or expand operations.

By using these technologies, Nigerian entrepreneurs can participate in formal financial systems and build stronger, more resilient businesses.

4. Tools Driving Financial Inclusion

-

Zaccheus: Provides real-time financial insights, cash flow forecasts, and risk-management features tailored for SMEs.

-

Mobile Banking Apps: Enable quick transfers, balance checks, and secure payments.

-

Payment Gateways: Platforms like Paystack and Flutterwave allow businesses to accept payments from customers anywhere.

-

Digital Wallets: Services such as Opay and Paga give entrepreneurs cashless options for everyday transactions.

5. Benefits of Tech-Driven Financial Inclusion

Technology gives entrepreneurs several advantages that help them grow:

-

Improved Cash Flow Management through accurate tracking tools.

-

Access to Capital with simplified lending processes.

-

Better Decision-Making using real-time financial data.

-

Cost and Time Efficiency from automation that reduces manual work.

-

Scalable Growth supported by tools like Zaccheus that guide financial planning.

FAQs

-

How does technology improve financial inclusion for Nigerian entrepreneurs?

Technology offers access to banking, loans, digital payments, and automated financial insights that were previously difficult for many entrepreneurs to obtain. -

Can small businesses without collateral access loans through fintech?

Yes. Many digital lenders provide microloans and working capital with flexible requirements. -

How does Zaccheus help entrepreneurs?

Zaccheus automates financial analysis, builds forecasts, and creates investor-ready reports that help entrepreneurs manage money wisely. -

Are mobile banking platforms safe?

Most platforms use encryption, two-factor authentication, and fraud monitoring to protect transactions and account information. -

Why is financial inclusion important for growth?

It helps entrepreneurs access capital, manage finances better, and scale operations in a sustainable way.

Conclusion

Technology is transforming financial inclusion in Nigeria and giving entrepreneurs the tools they need to succeed. From digital banking to AI-powered platforms like Zaccheus, small business owners can now access financial services that improve decision-making, strengthen operations, and support long-term growth. Entrepreneurs who embrace these tools are better equipped to overcome traditional barriers and unlock their business potential.

Suggested read: The “Agency” Dilemma: Managing Project-Based Finances vs. Recurring Revenue

Start using Zaccheus today to gain control of your finances, forecast growth, and build a stronger business.

Suggested read: Business vs. Pleasure: The Danger of Commingling Funds