Avoid Penalties: When to Remit Withholding Tax in Nigeria (2025 Deadlines)

If you run a business or work as a freelancer in Nigeria, understanding withholding tax and keeping up with the …

If you run a business or work as a freelancer in Nigeria, understanding withholding tax and keeping up with the withholding tax Nigeria due date is non-negotiable. Many small businesses lose money each year to fines and penalties simply because they miss the correct filing deadline.

In this guide, you’ll learn everything you need to know about the withholding tax Nigeria due date — including who should remit WHT, the differences between FIRS and SIRS deadlines, and how to stay 100% compliant using smart accounting automation tools like Zaccheus AI CFO.

What is Withholding Tax (WHT) in Nigeria?

Withholding tax is an advance payment of income tax deducted at source from specific payments such as contracts, rent, dividends, and professional fees. It’s a tax collection mechanism used by both the Federal Inland Revenue Service (FIRS) and State Internal Revenue Services (SIRS).

Common payments subject to WHT include:

-

Consultancy and professional services

-

Rent and lease payments

-

Dividends and interest

-

Royalties

-

Contracts and supplies

The deducted tax must then be remitted to the appropriate authority by a specified due date.

Suggested read: The Hidden Drain: 5 Ways Nigerian SMEs Lose Cash Without Noticing

Withholding Tax Nigeria Due Date by Category

| Category | Tax Authority | Due Date | Example |

|---|---|---|---|

| Federal (FIRS) | Federal Inland Revenue Service | 21st of the following month | Deducted in May → remit by June 21 |

| State (SIRS) | State Internal Revenue Service | 30th of the following month | Deducted in May → remit by June 30 |

| PAYE (Employees’ Tax) | State Internal Revenue | 10th of the following month | Deducted in May → remit by June 10 |

| Related-party transactions | Depends on payment timing | Earlier of payment or recognition | If recorded in May but unpaid, WHT applies |

These dates remain consistent under the Deduction of Tax at Source (Withholding) Regulations 2024, as confirmed by Dentons ACAS-Law.

FIRS vs SIRS: Key Differences

1. Taxpayer Jurisdiction

-

FIRS: Companies incorporated under CAMA or entities dealing with federal matters.

-

SIRS: Individuals, sole proprietors, partnerships, and unincorporated entities within the state.

2. Remittance Channels

-

FIRS: Through the TaxPro Max portal.

-

SIRS: Each state has its own online remittance system (e.g., Lagos, Rivers, or Oyo IRS portals).

3. Applicable Rates

-

WHT rates range from 5% to 10%, depending on the nature of the transaction (services, rent, dividends, etc.).

Penalties for Late WHT Remittance in Nigeria

Failing to remit withholding tax on time can result in serious financial and legal consequences.

Penalties include:

-

10% of the unremitted tax amount as a fine.

-

Interest charged at the prevailing commercial rate.

-

Possible prosecution for continuous default.

Example:

If your company deducted ₦1,000,000 in WHT and failed to remit by the due date, you could face a ₦100,000 fine plus interest.

Suggested read: The Rise of the Zero-Employee Finance Department

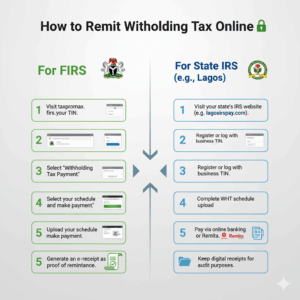

How to Remit Withholding Tax Online

For FIRS:

-

Visit taxpromax.firs.gov.ng.

-

Log in with your TIN.

-

Select “Withholding Tax Payment.”

-

Upload your schedule and make payment.

-

Generate an e-receipt as proof of remittance.

For State IRS (e.g., Lagos)

-

Visit your state’s IRS website (e.g., lagosirspay.com).

-

Register or log in with your business TIN.

-

Complete WHT schedule upload.

-

Pay via online banking or Remita.

-

Keep digital receipts for audit purposes.

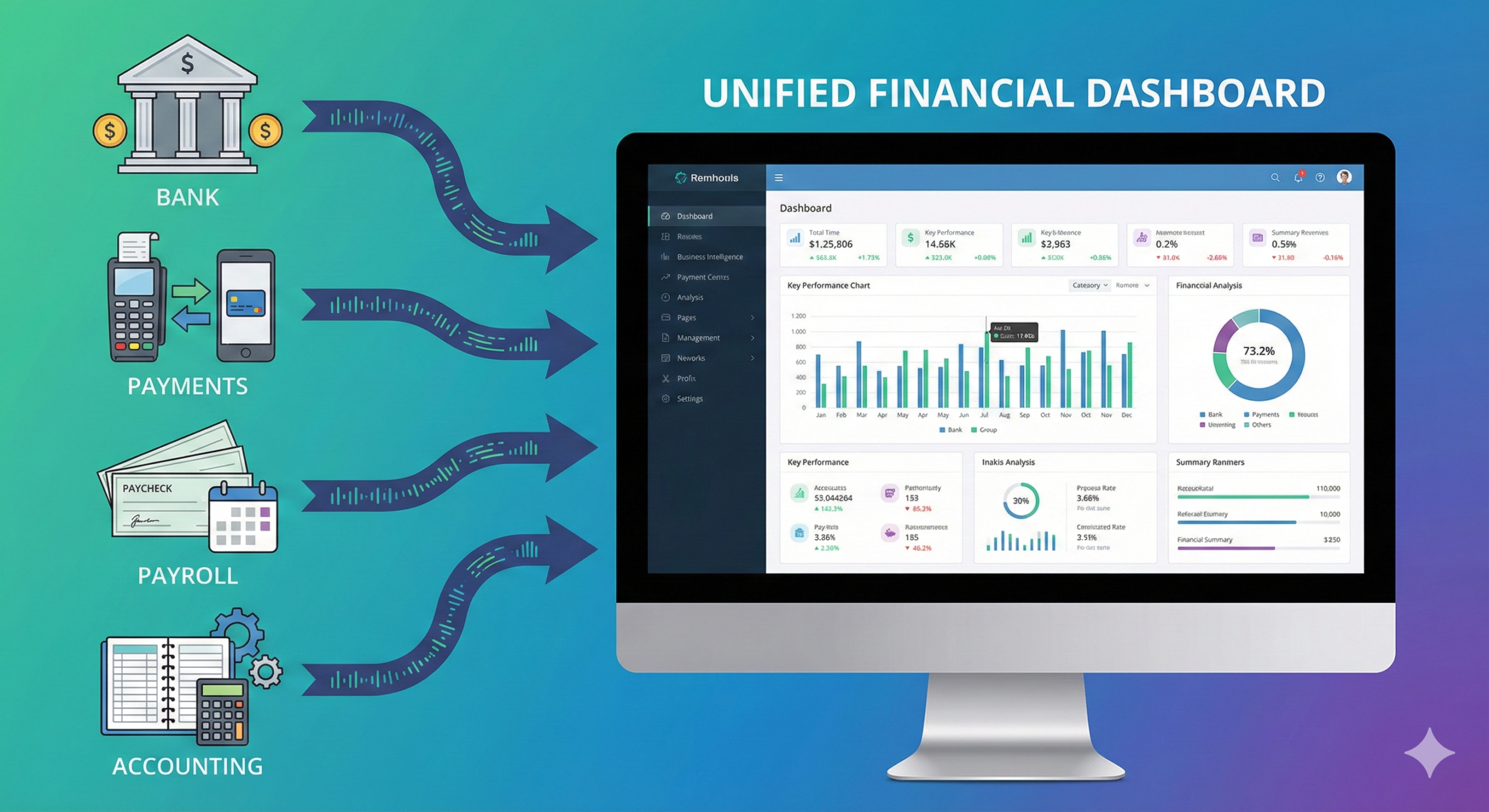

How Zaccheus Simplifies Withholding Tax Compliance

Staying compliant shouldn’t be stressful. Zaccheus automates the tedious part of managing taxes, payments, and deadlines.

Suggested read: The Joint Revenue Board: How Your NIN, BVN, and Tax ID Are Now Linked

Here’s how Zaccheus helps:

-

Tracks WHT deduction deadlines automatically.

-

Sends reminders for FIRS and SIRS due dates.

-

Generates ready-to-upload schedules for TaxPro Max.

-

Consolidates all financial and tax reports in one dashboard.

Tip: Automating compliance with Zaccheus can help you avoid penalties and save hours of manual tax management each month.

Suggested read: VAT Fiscalisation Explained: Why Your Business Needs Automated E-Invoicing Today

Try Zaccheus free at usezaccheus.com.

Frequently Asked Questions (FAQ)

1. What is the withholding tax due date in Nigeria?

The withholding tax Nigeria due date is the 21st of the following month for FIRS and the 30th for SIRS.

2. Who is responsible for remitting WHT?

The payer (business or individual making payment) must deduct and remit the withholding tax to the correct authority.

3. Can I remit withholding tax late?

Yes, but penalties apply: 10% of the tax due plus interest. Early remittance is strongly advised.

4. Is withholding tax the same as income tax?

No. WHT is a prepayment of income tax. It’s later credited against your final tax liability.

5. How can Zaccheus help with withholding tax management?

Zaccheus automates reminders, filings, and tax tracking, reducing errors and ensuring full compliance.

Conclusion and CTA

Understanding the withholding tax Nigeria due date is critical for every business and freelancer. To stay compliant, remit to FIRS by the 21st and to SIRS by the 30th of the following month. Missing these dates can lead to costly penalties and unnecessary stress.

Instead of tracking deadlines manually, let Zaccheus AI CFO handle it for you. It automatically monitors your withholding tax Nigeria due date, reminds you ahead of time, and generates schedules ready for upload on FIRS or SIRS portals.

✅ Stay compliant, save hours of admin work, and focus on growing your business.

👉 Get started free today at usezaccheus.com