Withholding Tax (WHT) Simplified: How to Stop Losing 10% on Every Invoice

You send an invoice for ₦1,000,000. Your client pays ₦900,000. No warning. No apology. If this keeps happening, you are …

You send an invoice for ₦1,000,000.

Your client pays ₦900,000.

No warning. No apology.

If this keeps happening, you are experiencing Withholding Tax (WHT).

Across Nigeria, freelancers, consultants, and SMEs lose millions of naira every year simply because they do not understand how WHT works or how to reclaim it. The truth is simple. WHT is not a loss unless you ignore it.

This guide explains Withholding Tax (WHT) in clear terms, shows how it affects your cash flow, and teaches you how to stop losing 10% on every invoice.

What Is Withholding Tax (WHT)?

Withholding Tax (WHT) is an advance tax payment deducted from your income at the point of payment.

Instead of receiving the full invoice amount, your client withholds a percentage and remits it to the Federal Inland Revenue Service (FIRS) on your behalf.

Important things to know:

- WHT is not an extra tax

- It is part of your income tax

- It should reduce what you owe FIRS at year-end

If you do not track it properly, it quietly becomes lost money.

Why WHT Exists in Nigeria

The Nigerian government introduced Withholding Tax (WHT) to improve tax compliance and reduce evasion.

Suggested read: Small Company Tax Exemption: Is Your Business Really Tax-Free at ₦25m or ₦50m?

WHT helps FIRS:

- Collect taxes earlier

- Track business income

- Ensure companies and freelancers pay their fair share

For the government, it works well.

For businesses, it creates cash flow pressure if unmanaged.

How WHT Affects Your Cash Flow

Let us look at a realistic example.

- Monthly invoices: ₦5,000,000

- WHT deducted at 10%: ₦500,000

- Annual WHT withheld: ₦6,000,000

That is ₦6 million you never touched during the year.

If you fail to claim this amount during tax filing, FIRS keeps it permanently. That is why understanding Withholding Tax (WHT) is a survival skill for Nigerian businesses.

Who Is Required to Deduct WHT?

In Nigeria, WHT is typically deducted when your client is:

- A registered company

- A government ministry, department, or agency

- A large corporate organization

- A tax-compliant business entity

Individuals and very small informal businesses usually do not deduct WHT.

This explains why freelancers often notice WHT only after landing bigger corporate clients.

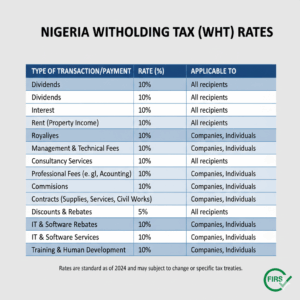

Common WHT Rates in Nigeria

In Nigeria, Withholding Tax (WHT) rates depend on the type of transaction.

Common examples include:

Suggested read: The 2025 Finance Act: 5 Clauses That Will Change How You Do Business

- Professional and consultancy services: 10%

- Technical services: 10%

- Contracts and supplies: 5%

- Rent: 10%

- Interest and dividends: 10%

These rates are deducted before payment and remitted to FIRS.

A Short Story: The ₦12 Million Mistake

Ayo ran a growing IT consultancy in Lagos. His invoices were large, payments were steady, and clients were reputable companies.

At the end of three years, his tax consultant asked for his WHT credit notes.

Ayo had none.

Over time, his clients had deducted over ₦12,000,000 in Withholding Tax. Since he never tracked or claimed it, FIRS treated it as unclaimed tax.

That ₦12 million could have funded new hires, office expansion, or equipment. Instead, it vanished.

The lesson is clear. WHT only becomes a loss when you fail to manage it.

How to Stop Losing 10% on Every Invoice

You cannot always avoid Withholding Tax (WHT) in Nigeria, but you can control its impact.

1. Always Collect Your WHT Credit Notes

A WHT credit note proves that tax was deducted and paid to FIRS.

No credit note means no tax relief.

Suggested read: Nigeria Tax Act 2025 Is Here: 5 Things Every Lagos Founder Must Do by Monday

Make it standard practice to request this document after every payment.

2. Record WHT Separately in Your Books

Your records should clearly show:

- Gross invoice amount

- WHT deducted

- Net amount received

Never treat WHT as income. It is a tax credit, not revenue.

3. Reconcile WHT Monthly

Monthly reconciliation helps you:

- Identify missing credit notes

- Confirm remittances to FIRS

- Avoid disputes during tax audits

Waiting until year-end is risky and expensive.

4. Claim WHT When Filing Taxes

This is the most important step.

When filing Companies Income Tax or Personal Income Tax:

- WHT should reduce your total tax payable

- Or generate a refund if overpaid

Failing to claim WHT means donating money to FIRS unnecessarily.

How Zaccheus Helps You Track WHT Automatically

Manually tracking Withholding Tax (WHT) across multiple invoices and clients is exhausting.

Zaccheus acts as your AI CFO, built for Nigerian freelancers and SMEs.

Suggested read: Stamp Duty on Electronic Transfers in Nigeria: What Businesses Must Know

With Zaccheus, you can:

- Automatically track WHT per invoice

- Separate tax credits from revenue

- Monitor outstanding WHT balances

- Prepare tax-ready reports for FIRS

Instead of guessing where your money went, Zaccheus shows you exactly what is owed, withheld, and recoverable.

Frequently Asked Questions

Is Withholding Tax an extra tax in Nigeria?

No. Withholding Tax (WHT) is an advance payment of income tax. When properly claimed, it reduces your final tax liability to FIRS.

Can I avoid WHT deductions?

If your client is legally required to deduct WHT, you cannot avoid it. Your focus should be on tracking and reclaiming it legally.

What happens if I lose my WHT credit notes?

Without credit notes, FIRS may reject your WHT claims. Always request, store, and reconcile them properly.

Does WHT apply to freelancers in Nigeria?

Yes. Freelancers and consultants are commonly subject to WHT, especially when working with registered companies.

How long can I claim WHT in Nigeria?

Tax authorities usually allow claims within a specific statutory period. Delaying increases the risk of losing the credit permanently.

Final Thoughts and Next Steps

Withholding Tax (WHT) is not stealing your money. Poor record-keeping is.

Once you understand how WHT works in Nigeria and track it properly, that missing 10% stops hurting your cash flow and starts reducing your tax bill.

If you want clarity, control, and confidence in your finances, it is time to upgrade how you manage WHT.

Suggested read: Payroll Tax (PAYE) for Remote Teams: Paying Staff in Different States

Call to Action

Stop losing thousands or even millions of naira to poor tax tracking.

Visit usezaccheus.com and let Zaccheus, your AI CFO, track Withholding Tax, protect your cash flow, and keep your business tax-ready effortlessly.