Xero Nigeria: 7 Proven Insights on What Works, What Breaks, and How Zaccheus Fixes It

Many Nigerian SMEs and startups are turning to cloud accounting tools for efficiency and scalability. Among them, Xero often comes …

Many Nigerian SMEs and startups are turning to cloud accounting tools for efficiency and scalability. Among them, Xero often comes up as a go-to choice because of its international reputation, rich feature set, and integrations. Yet, using Xero “as is” in Nigeria exposes businesses to challenges, ranging from tax complexity to payment reconciliation.

This article breaks down what works well with Xero for Nigerian businesses, where it falls short, and how Zaccheus, as an AI CFO platform built for Africa, fills in the gaps to give Nigerian business owners smoother, more compliant, and more actionable financial tools.

2. What Xero Does Well for Nigerian Businesses

Here are the strengths of Xero when applied to Nigerian SMEs, freelancers, and small enterprises:

2.1 Cloud-based Access & Real-Time Financial Visibility

-

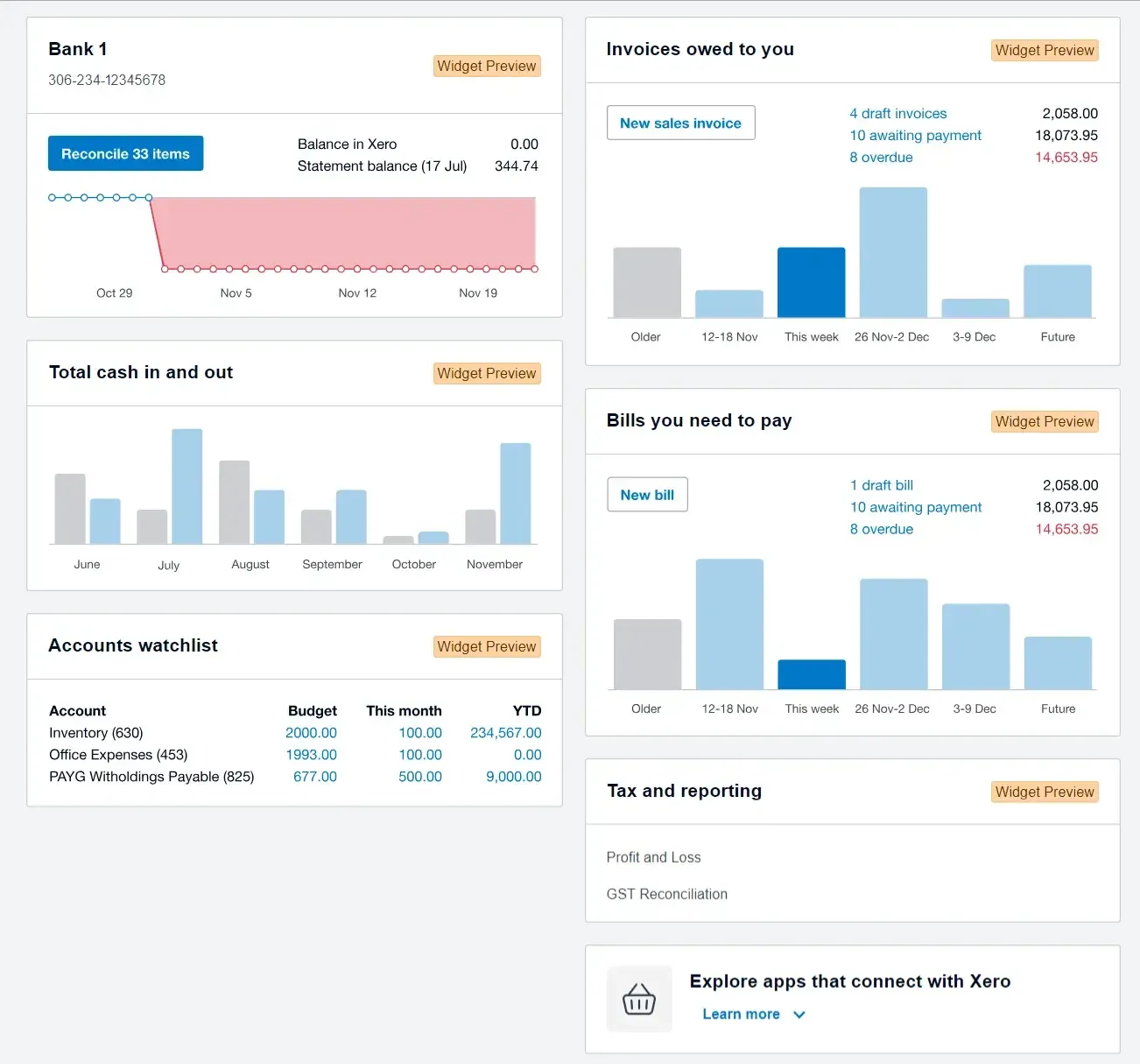

Being cloud-hosted, Xero allows access to books, financial reports, and invoicing from anywhere. This is especially useful for remote working, multi-location businesses, or where accountants / bookkeepers and business owners aren’t co-located.

-

Real-time dashboards give visibility into cash flow, overdue invoices, profit & loss, expenses, etc., which helps in decision-making and planning.

2.2 Automation & Integrations

-

Xero integrates with many external tools: invoicing, payroll, expense tracking, payments. This helps reduce manual work.

-

For example, Nigerian businesses can use the Paystack + Xero integration to automatically record payments, fees, and reconciliations.

-

Also integrations with Zapier, foreign currency tools, etc., help automate currency conversion workflows.

2.3 Multi-currency & Export / International Trade Support

-

For businesses that import goods, invoice foreign clients, or use foreign payment gateways, Xero’s multi-currency features allow them to issue invoices in foreign currency, keep track of gains/losses from exchange rates, etc.

-

Also useful if business operates in foreign markets or needs to send money abroad or deal in USD, EUR, etc.

3. Challenges & Limitations of Xero in a Nigerian Context

While Xero has many useful features, several issues come up repeatedly when Nigerian businesses try to use it “off the shelf.” These pain points reduce its usefulness unless supplemented with local fixes.

Suggested read: The Hidden Drain: 5 Ways Nigerian SMEs Lose Cash Without Noticing

3.1 Bank Feeds, Currency Instability, & Exchange Rate Problems

-

Bank Feeds are often unreliable. Some Nigerian banks may not provide stable API connections, frequent downtimes, or delayed statement uploads. This means manual upload or manual reconciliation is still needed, which negates a lot of automation.

-

Currency volatility in Nigeria (e.g. rapid changes in Naira exchange rates) makes multi-currency accounting more complex. Xero needs accurate and timely updates of rates; delayed updates lead to mis-valued invoices, distorted financials, and even profit/loss surprises.

-

Also, when revenue is received via foreign sources (PayPal, Stripe, etc.), issues with converting, tracking fees and deposit times make reconciliation harder.

3.2 Local Tax, Regulatory & Statutory Compliance Issues

-

Nigeria’s tax environment (federal, state, local: VAT, Company Income Tax, withholding tax, etc.) has many specific rules. These include deadlines, dynamic tax rates, special provisions (e.g., small business exemptions). Xero may not always be configured for all of them out-of-the-box.

-

Regulatory filings (e.g., CAC, Federal Inland Revenue Service [FIRS]) demand certain forms, audit trails, document formats, schedules etc., which sometimes require manual efforts outside Xero or custom work.

-

Local statutory compliance like payroll deductions (PAYE), pensions, National Housing Fund, etc., may require integrations or manual adjustments.

3.3 Payment Gateways, Cash Transactions, Informality & Reconciliation Issues

-

Many Nigerian businesses still operate heavily in cash or via informal means. Cash transactions are often under-documented or not entered in real time. This breaks reconciliation, and sometimes leads to missing expenses or under-reporting revenue.

-

Payment gateways like Paystack, Flutterwave, etc. do integrate with Xero, but users frequently report bugs, delays, missing batches, or mismatches in how fees are handled. For example, Paystack’s Xero integration has mixed reviews: ease of setup, but instability and bugs have been reported.

3.4 Infrastructure, Localization, and UX Gaps

-

Unstable internet / power (though improving) still present challenges. If you lose connection or power, you may not access cloud tools when you need them most.

-

Local currency formatting, local language/contextual guidance, localized customer support are sometimes inadequate.

-

Also, educational gap: many business owners or operators are not accounting experts; they need tools to interpret reports, alerts, compliance warnings in simple, actionable way.

4. How Zaccheus Solves These Issues Locally

Zaccheus is positioned to fill precisely the gaps that many Nigerian businesses face with Xero (or with accounting tools generally). Here are ways Zaccheus adds value / complements / sometimes replaces parts of what Xero does poorly:

Suggested read: The Rise of the Zero-Employee Finance Department

4.1 Local Regulatory Alignment & Tax Compliance Automation

-

Zaccheus includes automated reminders, pre-filled drafts for local statutory filings (e.g. FIRS tax, VAT, etc.), pension / PAYE obligations, etc., tailored for Nigerian law. This reduces the need to manually track regulatory calendar.

-

Ensures chart of accounts mapping considers Nigerian tax codes, withholding, etc., so reports are meaningful for Nigerian audits and statutory bodies.

4.2 Better Handling of Local Payment Gateways & Reconciliation

-

Integration with local gateways (Paystack, Flutterwave, etc.) but with logic to handle fees, settlement delays, and reconcile automatically vs manual intervention. Zaccheus can alert when settlement amounts don’t match expected amounts, or when payments are stuck.

-

Cash transaction management tools: flags, reminders, mobile capture of receipts, expense tracking even offline, so you don’t lose track of non-digital payments.

4.3 Real-Time Insights, Alerts & Preventing Cost Leakages

-

Zaccheus can monitor bank charges (which are often hidden or high in transactions), unusual spikes in expenses, margin erosion due to exchange losses, currency depreciation, etc. These are often areas where Xero’s standard dashboards don’t proactively warn.

-

Offers insights in accessible language rather than technical accounting terms; helps business owners understand “what to do next,” not just “what the numbers are.”

4.4 Offline / Low-Bandwidth Friendly Features & Localization

-

Because internet power etc. are sometimes unstable, Zaccheus builds resilience: asynchronous sync, mobile-friendly operations, low data usage modes, offline receipt capture etc.

-

Customer support, guides, templates in Nigerian context, local case studies, pricing in Naira or at least with Nigerian context so business owners are not shocked by foreign-currency denominated features or invoice charges.

5. Case Examples / Hypotheticals

To illustrate how these work in practice, here are hypotheticals:

Suggested read: The Joint Revenue Board: How Your NIN, BVN, and Tax ID Are Now Linked

-

SME that imports raw materials: Using Xero, the owner invoices in USD, tracks expenses in USD. But when the Naira weakens sharply, their margins get eaten, and delayed bank feeds make reconciling delayed invoices hard. Zaccheus alerts them to hedging options, flags that cash flow is tightening, suggests adjusting pricing terms or asking clients for partial dollar payments, helping avoid surprise losses.

-

Freelancer using Paystack & Xero: Their invoices are paid via Paystack but fees and delays cause mismatch. Xero’s integration sometimes mis-classifies fees. Zaccheus auto-imports Paystack statements, matches transaction vs invoice, flags mismatches, helps ensure bank reconciliation is accurate, and taxes computed correctly.

-

Business with heavy cash transactions (restaurants, traders, etc.): Many small expenses or revenues are in cash and often unrecorded till month end. Xero’s usage may lag, resulting in missing expense deductions or over-reporting cash on hand. Zaccheus mobile receipt capture + offline entry helps ensure daily capture; end-of-month reports are more accurate; insights show where cash leakages occur.

6. Conclusion & Key Takeaways

-

Xero for Nigerian businesses offers strong advantages: cloud access, decent automation, multi-currency, good integrations with some payment gateways.

-

But the limitations are real: local tax/regulation gaps; unreliable bank feeds; currency volatility; heavy reliance on cash; infrastructure challenges.

-

Zaccheus complements Xero or even substitutes parts of what Xero struggles with in Nigeria, by localizing tax compliance, smoothing payment and reconciliation issues, providing proactive alerts and local context, and building tools that work even in low infrastructure settings.

If you are a Nigerian SME or freelancer, combining Xero with Zaccheus gives you powerful tools: the global reliability of Xero plus local intelligence and responsiveness.

7. FAQs

Q1: Is Xero legal & acceptable for tax / audit-purposes in Nigeria?

Yes, as long as your bookkeeping is complete, accurate, and meets statutory requirements (e.g. correct chart of accounts, appropriate tax filings). But you will likely need to do manual adjustments or use add-ons to cover all local tax regimes. Zaccheus can help ensure those statutory rules are accounted for.

Suggested read: VAT Fiscalisation Explained: Why Your Business Needs Automated E-Invoicing Today

Q2: Can Xero handle Naira as base currency and frequent currency depreciation?

Technically yes: you can set Naira as base currency, enable multi-currency. But exchange rate updates, foreign currency transactions, gains/losses must be manually managed, and rapid depreciation presents risk. Zaccheus can help monitor exposures and suggest adjustments.

Q3: What are safer options if my bank doesn’t support stable bank feeds with Xero?

You may need to upload bank statements manually, or use intermediaries, or tools that pull statements from your bank. Zaccheus supports these workflows, plus helps you detect mismatches.

Q4: How expensive is using Xero + Zaccheus compared to local or simpler bookkeeping?

It depends on your transaction volume, number of users, and complexity (multi-currency, payroll, etc.). The combination may cost more than a basic local bookkeeping setup but pays off through saved time, fewer fines or mistakes, better visibility, and better decision making. Zaccheus is designed to minimize hidden costs (unexpected fees, fines, errors).

Q5: I run a business in a remote region with spotty internet—can I still use these tools?

Yes—with some limitations. Zaccheus plans for mobile/offline capture of receipts and sync when connectivity returns; Xero needs internet for many functions. Always keep backups and try to work with local storage where possible.

Strong Call to Action

If you want the power of Xero for your Nigerian business without the pain of managing every regulatory, payment, and local detail yourself, let Zaccheus be your AI CFO partner. Zaccheus bridges the gap between global tools and local reality.

➡️ Try Zaccheus today — get streamlined compliance, smarter insights, and financial control that works in Nigeria. Sign up or request a demo at usezaccheus.com