5 Powerful Unit Economics Nigeria Startups Must Master for Profit

If you’re a Nigerian founder, you already know how hard it is to grow a business here. Between unstable exchange …

If you’re a Nigerian founder, you already know how hard it is to grow a business here. Between unstable exchange rates, rising costs, and tight investor funding, profitability isn’t optional, it’s survival.

But here’s the truth: you can’t improve what you don’t measure. The difference between startups that scale sustainably and those that burn out lies in how well founders understand their unit economics, how much they earn, spend, and retain per customer.

In this guide, we’ll break down the 5 key financial metrics Nigerian startups must track to understand and improve profitability. You’ll learn what they mean, how to calculate them, and how to use them to make smarter business decisions.

Featured Snippet Answer

Unit economics are the revenues and costs linked to one customer or product unit. Nigerian startups must track Customer Acquisition Cost (CAC), Lifetime Value (LTV), LTV:CAC Ratio, Payback Period, and Contribution Margin to know if they’re profitable or losing money per customer.

What Unit Economics Means for Nigerian Startups

In simple terms, unit economics show whether your business model makes sense on a per-customer basis.

For example:

If you spend ₦2,000 to get one customer but that customer only brings ₦1,000 in profit, your model is broken, no matter how many users you have.

Understanding unit economics helps Nigerian founders:

-

Know whether their business can scale profitably.

-

Make smarter pricing and marketing decisions.

-

Convince investors that the model is sustainable.

In a tough economy where venture capital is shrinking, investors in Lagos and across Africa now ask one big question before funding:

👉 “Show me your unit economics.”

Suggested read: The Hidden Drain: 5 Ways Nigerian SMEs Lose Cash Without Noticing

Customer Acquisition Cost (CAC)

Definition: The average cost of acquiring one new customer.

Formula:

CAC = Total marketing + sales spend ÷ Number of new customers acquired

Example:

If your fashion e-commerce startup spends ₦1,000,000 on Facebook ads and influencer campaigns in a month and acquires 2,000 customers:

CAC = 1,000,000 ÷ 2,000 = ₦500 per customer

Why it matters:

In Nigeria, digital ad costs (especially on Meta and Google) have risen due to FX fluctuations. If your CAC is too high, it will eat up your profits fast.

Tips to reduce CAC:

Suggested read: The Rise of the Zero-Employee Finance Department

-

Use referral programs and influencer partnerships.

-

Focus on organic content and SEO (cheaper long-term).

-

Build WhatsApp communities or newsletters for retargeting.

2️⃣ Lifetime Value (LTV)

Definition: The total revenue (or profit) you earn from a customer over the entire time they stay with your business.

Formula:

LTV = Average revenue per customer × Gross margin × Average customer lifespan

Example:

If each customer spends ₦5,000/month, your gross margin is 50%, and customers stay for 6 months:

LTV = 5,000 × 0.5 × 6 = ₦15,000

Why it matters:

In Nigeria, customer loyalty can be low. People switch fast if competitors offer cheaper deals or faster delivery. Increasing retention (and therefore LTV) is cheaper than acquiring new users.

How to grow LTV:

-

Improve customer service response time (especially on WhatsApp).

-

Use loyalty points, discounts, or subscription models.

-

Offer complementary products or upsells.

LTV : CAC Ratio

Definition: This ratio shows how much you earn for every ₦1 spent acquiring a customer.

Suggested read: The Joint Revenue Board: How Your NIN, BVN, and Tax ID Are Now Linked

Formula:

LTV : CAC = Lifetime Value ÷ Customer Acquisition Cost

Example:

If your LTV is ₦15,000 and CAC is ₦3,000, then LTV:CAC = 15,000 ÷ 3,000 = 5:1

Benchmark:

-

Good: 3:1 or higher

-

Okay: 2:1

-

Bad: Below 1:1 (means you lose money on every sale)

If your ratio is strong, you’re ready to scale. If not, optimize marketing, pricing, and retention.

Suggested read: VAT Fiscalisation Explained: Why Your Business Needs Automated E-Invoicing Today

CAC Payback Period

Definition: The time it takes to recover your CAC from a customer’s revenue or profit.

Formula:

Payback Period = CAC ÷ (Monthly profit per customer)

Example:

If your CAC = ₦3,000 and you earn ₦1,000 in profit from each customer monthly:

Payback Period = 3,000 ÷ 1,000 = 3 months

Why it matters:

In Nigeria, where cash flow is king, you need short payback periods (ideally under 6 months). It means your business isn’t constantly burning money.

To shorten your payback:

-

Upsell early (don’t wait 3 months to get repeat sales).

-

Collect prepayments or subscriptions.

-

Lower marketing spend per customer.

Contribution Margin

Definition: The profit left after paying all variable costs (like delivery, packaging, transaction fees) for one product or service.

Suggested read: Personal Income Tax vs Company Tax: Which Registration Is Better for You?

Formula:

Contribution Margin = Selling Price – Variable Costs

Example:

If you sell a skincare product for ₦8,000, and delivery + packaging + transaction costs = ₦3,000:

Contribution Margin = 8,000 – 3,000 = ₦5,000

Why it matters:

A high contribution margin gives you more flexibility for marketing, expansion, or price drops. Many Nigerian founders ignore this and assume revenue = profit, but without tracking contribution margin, you’ll never know your real unit profit.

How to Use These Metrics Together

| Metric | Ideal Benchmark | Problem If… | Fix |

|---|---|---|---|

| CAC | ₦500–₦3,000 (varies by industry) | Rising too fast | Improve targeting & content marketing |

| LTV | 3× CAC or more | Flat or falling | Focus on retention, not just acquisition |

| LTV:CAC | ≥ 3:1 | < 1:1 | Cut CAC or raise LTV |

| Payback Period | < 6 months | > 12 months | Offer subscriptions, reduce spend |

| Contribution Margin | > 40% | < 20% | Increase prices or reduce variable costs |

Common Mistakes Nigerian Startups Make

-

Chasing vanity metrics: Counting downloads or followers instead of paying customers.

-

Ignoring Naira volatility: Your dollar-based SaaS tools may double in cost overnight.

-

Underpricing products: Many founders fear losing customers and set prices too low.

-

Not tracking retention: Without repeat customers, CAC never pays back.

-

Neglecting cash flow: Even with strong LTV, if your payback period is long, you’ll run out of cash.

FAQ: Unit Economics for Nigerian Startups

Q1: What is unit economics in simple terms?

It’s knowing how much profit or loss you make from each customer after subtracting all direct costs.

Suggested read: Tax Credit for Going Digital in Nigeria: 2026 Guide

Q2: When should I start tracking these metrics?

From the first sale. Even rough estimates early on can help you make better pricing and marketing decisions.

Q3: Do these metrics apply to service businesses too?

Yes. Your “unit” might be one project, client, or billable hour — the principles are the same.

Q4: How often should I update these numbers?

Monthly. Nigeria’s inflation and FX changes can shift your costs fast.

Q5: What if my metrics look bad now?

That’s okay. The goal is to improve them steadily, not to be perfect overnight.

Conclusion & Call-to-Action

To build a profitable, scalable business in Nigeria, you must understand your unit economics.

Remember the five key metrics:

-

Customer Acquisition Cost (CAC)

-

Lifetime Value (LTV)

-

LTV:CAC Ratio

-

Payback Period

-

Contribution Margin

These numbers reveal whether your startup is truly sustainable or just burning cash.

Suggested read: Capital Gains Tax in Nigeria: Why Investors Are Recalculating Returns

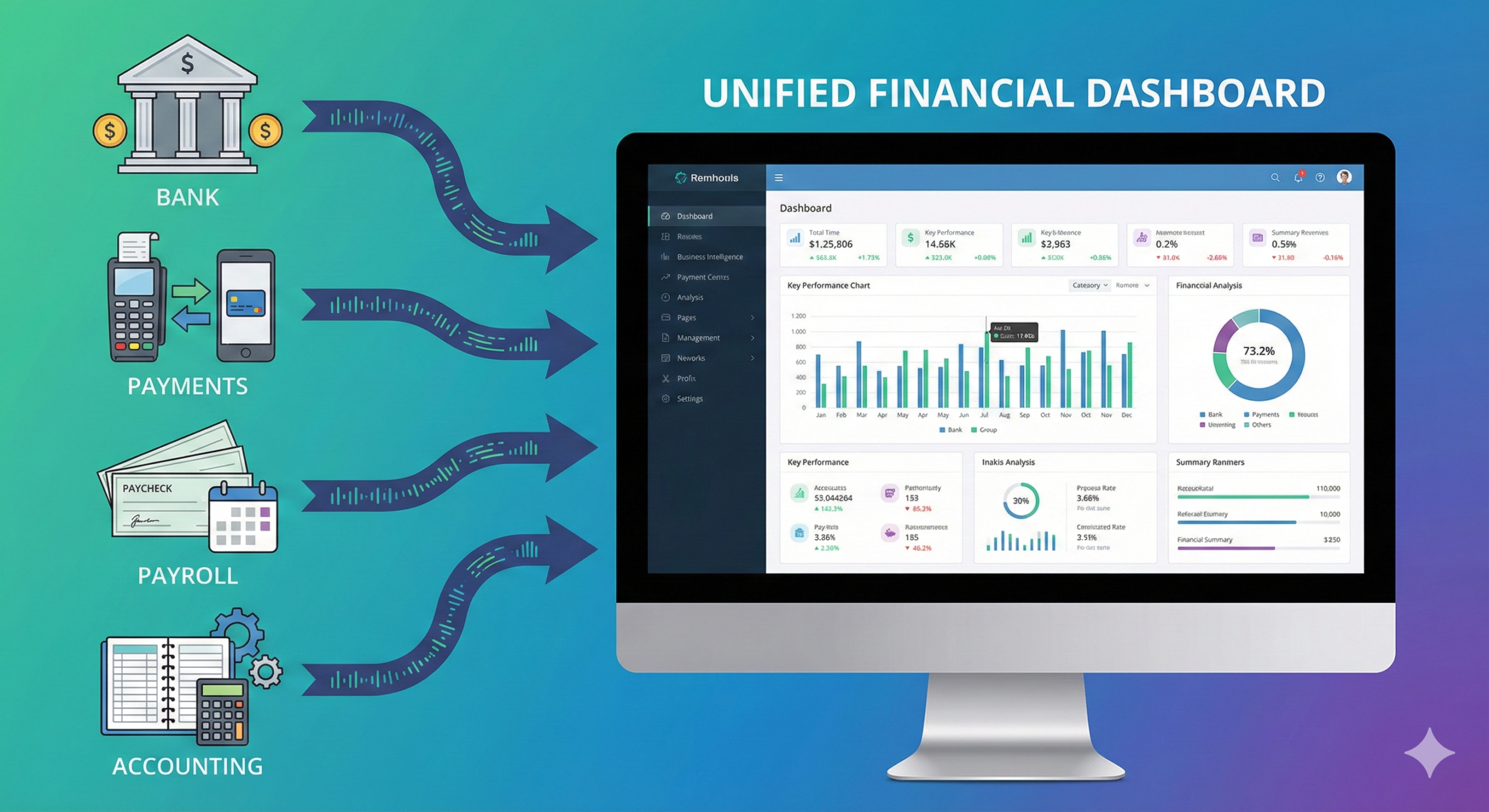

💡 Next Step: Use Zaccheus, your AI CFO to automatically calculate and track these five financial metrics every month. Zaccheus connects to your bank and payment systems, visualizes your CAC, LTV, and margins, and helps you make smarter financial decisions.

Download our Cash Flow Forecast Template tobuild realistic financial projections that complement your CAC, LTV, and margin analysis.

👉 Start free at usezaccheus.com and turn your startup into a profitable business today.